Click Here for the best range of Amazon Computers

Click Here for INL News Amazon Best Seller Books

Click Here for INL News Amazon Best Seller Books

Click Here for INL News Amazon Best Seller BooksClick Here for the best range of Amazon Computers

Click Here for INL News Amazon Best Seller Books

Amazon Electronics - Portable Projectors

Amazon Electronics - Portable Projectors

Click Here for INL News Amazon Best Seller Books

INLTV Uncensored News

INLTV is Easy To Find Hard To Leave

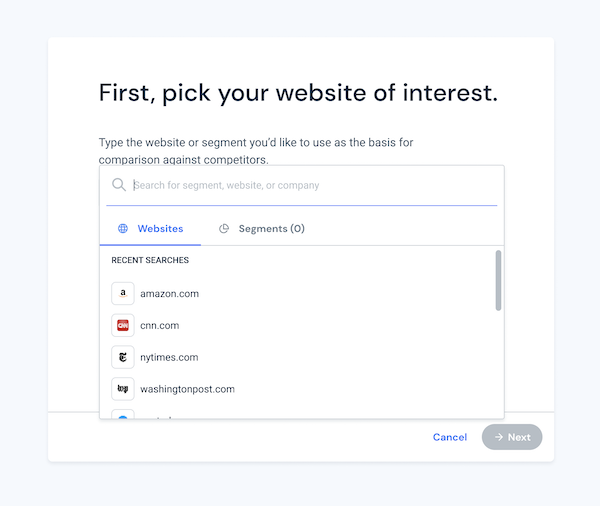

Similarweb.com

Website Traffic - Check and Analyze Any Website | Similarweb

SimilarWeb is an Israeli web analytics company that specializes in web traffic and performance. The company has 12 offices worldwide. It went public on the New York Stock Exchange (NYSE) on March 8th, 2022.

YahooRealEstate.com (y-realtor.com)

YahooRealEstate.com and (y-realtor.com)

make selling, buying, trading and renting real estate a breeze

Australian Real Estate | YahooRealEstate.com (y-realtor.com)

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

INLTV is Easy To Find Hard To Leave

Email Log In Link for INLTV.co.uk

Handy Easy Email and World News Links

GoogleSearch GMail YahooMail HotMail AOLMail

AustralianDailyNews wikipedia.org

INLNews rt.com AWNNews YahooMail HotMail

Similarweb devotes substantial effort and resources to ensure that we provide the most reliable data. For over 10 years, we have developed a unique, multi-dimensional approach to understanding the digital world.

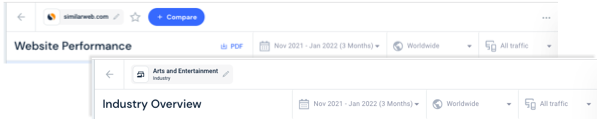

Connect your Google Analytics to directly measure your website vs. your competitors

In Website Analysis, click on “compare” to benchmark website performance across multiple websites

SimilarWeb offers a range of products that provide insights into website traffic and performance. Some of their products include:

- Digital Marketing Intelligence: Provides insights into digital marketing strategies and tactics of competitors.

- Website Traffic: Provides insights into website traffic and engagement metrics.

- Audience Analysis: Provides insights into audience demographics, interests, and behavior.Market Intelligence: Provides insights into market trends and opportunities.

You can find more information about SimilarWeb’s products on their pricing page

Similarweb.com Funding

Similarweb has acquired 5 organizations.

Their most recent acquisition was Rank Ranger on May 16, 2022.

Highlights

|

Investor Name

|

Lead Investor

|

Funding Round

|

Partners

|

|---|---|---|---|

Viola Growth

|

Yes |

Series F - Similarweb

|

Harel Beit-On |

ION Crossover Partners

|

Yes |

Series F - Similarweb

|

Gili Iohan |

Vintage Investment Partners

|

— |

Venture Round - Similarweb

|

— |

Saban Ventures

|

No |

Series F - Similarweb

|

— |

CE Ventures (CEIIF)

|

No |

Series F - Similarweb

|

Benjamin Weiss |

Viola Growth

|

Yes |

Series F - Similarweb

|

Harel Beit-On |

Lord David Alliance

|

No |

Series E - Similarweb

|

— |

Prosus & Naspers

|

Yes |

Series E - Similarweb

|

Russell Dreisenstock |

Lord David Alliance

|

No |

Series D - Similarweb

|

— |

Prosus & Naspers

|

Yes |

Series D - Similarweb

|

Russell Dreisenstock |

SimilarWeb’s revenue is $137.7M annually according to Zippia.

SimilarWeb announced that their fourth quarter 2021 revenue grew 51% year-over-year to $40.2 million.

According to Slintel, SimilarWeb has a market share of 0.02% in the web-analytics market and competes with 212 competitor tools in web-analytics category.

According to Moneymint, some of SimilarWeb’s competitors include SEMrush, Serpstat, Ahrefs, SpyFu, Mangools, Alexa, SEO PowerSuite and AWR Cloud. According to What Competitors, SimilarWeb’s biggest competitor is Google Analytics.

SimilarWeb business model

SimilarWeb offers an AI-based market intelligence platform that helps monitor web and mobile app traffic. The company gives a global multi-device market intelligence to understand, track, and grow digital market share. It allows the user to gain insight into any website’s statistics and strategy1. SimilarWeb’s business solutions power your teams to make strategic and tactical decisions that drive ROI and revenues

Is Similarweb's Data Reliable?

https://support.similarweb.

Through Similarweb’s robust data methodology, we provide statistically representative datasets that preserve variety across countries, industries, user groups, and devices, and have been proactive in diversifying our data inputs to be resilient against changes in the market.

SimilarWeb’s pricing model is not publicly available. However, you can contact them for pricing and get your custom quote.

SimilarWeb offers a range of features including website analysis, audience insights, traffic sources, industry analysis, keyword analysis and more.

How does SimilarWeb work?

SimilarWeb collects website data and then runs its algorithms to clean, match, synthesize, process input and blend inputs for data modelling1. It is a tool that estimates the total amount of traffic different websites get. It allows you to see competitors’ top traffic sources, broken down into six major categories, including referring sites, social traffic and top search keywords.

SimilarWeb gets the data used to generate the estimations you see on the platform from 4 main sources: Direct Measurement – millions of websites and apps choose to share their first-party analytics with us. Contributory Network – a collection of consumer products that aggregate anonymous device behavioral data

A Recent SparkToro study found that Similarweb’s traffic estimations are the most accurate and closely aligned to users’ Google Analytics data, against other digital intelligence providers like SEMRush and Ahrefs. The study notes that Similarweb's strength lies with sites that receive between 5K-100K GA users/mon

SimilarWeb customers

SimilarWeb has some pretty impressive customers, including Google, Amazon, Walmart, Booking.com, Adobe, Adidas and The Economist1. SimilarWeb enables companies to uncover their competitors’ online strategy, benchmark themselves and grow their digital market share

SimilarWeb is the official measure of the digital world

SimilarWeb Vision

We are committed to powering businesses around the globe with the best digital data.

SimilarWeb Mission

To create the most accurate, comprehensive, and actionable Digital Data, so every business can win their market

Our company is comprised of over 1,000 employees with locations on six different continents and is publicly traded on the New York Stock Exchange (Ticker: SMWB).

Similarweb Digital Data and insights power thousands of customers, from small businesses to large international enterprises.

Because we are an estimations tool, and we rely on a data collection process that captures billions of digital signals to fuel our powerful algorithms, we don’t expect our estimations to align exactly with your direct measurement data.

We provide a holistic view of the digital world, and expect trend alignment with your direct measurement data. For more information, visit Similarweb vs. Direct Measurement.

Small Sites

Later in 2023, we plan on releasing new functionality to our platform that will help us bring more reliable data to sites with relatively little traffic. While we’re constantly working to expand our coverage, you may run into more limited results if you are analyzing small sites.

Below are several frequently asked questions regarding Similarweb data estimations, particularly for small sites.

Why is there no data for the sites I’m analyzing?

In a constant effort to continuously improve our data accuracy, our findings show that for websites with a small number of visits, our estimations may be subject to a greater degree of variance to meet our desired level of accuracy. Hence, Similarweb will not present data for websites that receive below 5,000 monthly visits.

I know that a website has received more than 5,000 monthly visits. Why does it still show N/A?

The 5,000 visits threshold refers to last month’s data, per device, per country. Meaning, if a specific device (desktop/mobile web) has traffic above the 5,000 visits threshold last month, data will be available for metrics set to that device/ country. This applies to Total Traffic as well.

You underestimate my site, my site has over 5K monthly visits

Our data methodology is different than Direct measurement. Hence, there might be a discrepancy when estimating your site. We encourage you to connect your Google Analytics to Similarweb. You can do this publicly (all users will see this data) or privately (only you will see this data). Read here to learn how.

What happens if a site's visits vary during an analyzed time period?

(For example: April = 1000 visits, May = 6000 visits, June = 3000 visits)

We look at the last available snapshot. If the last snapshot (June for the sake of the example) is less than 5000 visits then we won’t display any data.

When comparing sites, suddenly the data for a site is N/A. Why is that?

The issue might be when analyzing sites with small or no data. Please remove the sites which don’t have a sufficient amount of visits, to see data for the other sites.

When analyzing certain features, suddenly the data is N/A. Why is that?

Some of our features support only Desktop data. Therefore, if a website has less than 5,000 monthly visits from Desktop - we won’t have data to display.

Additional Resources

For additional information on Similarweb data methodologies, visit How We Measure the Digital World.

Similarweb develops tools that enable the analysis of the traffic and behavior of users on websites and apps. The service and datasets are provided in a limited free edition, but the paid platform is addressed to SMBs and large companies which require access to accurate comprehensive data at larger scales for marketing, sales and Market research. The data is collected from a number of different sources that provide information about the internet usage of users, including various information partners, and anonymous data from users of the various dedicated browser addons that the company distributes.

Similarweb Ranking

Similarweb ranks websites and apps based on traffic and engagement metrics. Its ranking is calculated according to the collected datasets and updated on a monthly basis with new data. The ranking system covers 210 categories of websites and apps in 190 countries and was designed to be an estimate of a website's popularity & growth potential. The company ranks websites based on traffic and engagement data, and ranks apps in the App Store (iOS/iPadOS) and Google Play Store based on installs & active user data. Analytics from SimilarWeb are comparable (albeit usually lower) than from Google Analytics.

Similarweb Acquisitions

On December 10, 2015, Similarweb announced it had acquired Quettra, a Silicon Valley-based mobile intelligence startup, to boost its mobile operations. In November 2021, Similarweb acquired "Embee" to extend its mobile user data sets.

In May 2022, Similarweb acquired "RankRanger" to extend its offering to the SEO industry. Rank Ranger provides keyword rank tracking services and advanced API's that will be added to Similarweb's existing SEO tools to create a more comprehensive suite

The company was founded in 2007 by Or Offer in Tel Aviv, Israel. By 2009, Similarweb won the first Israeli SeedCamp, attracting the attention of international media and investors. The company raised its Series A round of $1.1 million[6] with the investment being led by Yossi Vardi, and Docor International Management. SimilarSites, a browser extension to help users find sites similar to those they are visiting, was launched later that year.

On September 24, 2013, the company closed a Series B round led by David Alliance, Moshe Lichtman with the participation of existing investor Docor International Management.

On February 24, 2014, South Africa media giant Naspers invested $18 million into Similarweb and leading their Series C round. Within a month, Similarweb used a part of the capital for the acquisition of Israeli early-stage company TapDog for a few million dollars in shares and cash, less than a year after TapDog was founded.

In November 2014, Similarweb raised $15 million in a Series D investment.

In July 2015, Similarweb acquired personalized content discovery platform developer Swayy.

In July 2017, the company announced a $47 million round of financing led by Viola Group, Saban Ventures with participation from CE Ventures and existing investors.

In May 2021, Similarweb made its public debut on the NYSE at a $1.6B valuation.

In October 2021, Similarweb won "Best Alternative data Provider" at Hedgeweek Americas Awards 2021, for their investors intelligence suite

On February 16, 2022, Similarweb reported earnings for Q4 2021, Q4 revenue of $40.2m and Q4 ARR of $165m.

|

Type of site

|

Public |

|---|---|

| Traded as | NYSE: SMWB |

| Founded | 2007 |

| Headquarters | |

| Area served | Worldwide |

| Founder(s) | Or Offer |

| Chairperson | Or Offer |

| Key people |

|

| Industry | Advertising, information technology, market intelligence, web traffic |

| Services | Web analytics, web traffic and ranking |

| Revenue | |

| Employees | 1,288 |

| URL | similarweb.com |

| Launched | 2007 |

| Current status | Online |

Similarweb's controversial route to Wall Street - Globes

Some experts claim the Israeli web analysis company's past practices violated user privacy, before tougher EU regulations and Google policies were implemented.

In recent years, Similarweb (NYSE: SMWB) has become the leading measurement tool for the activities of websites and apps. The company's successful Wall Street IPO in May put the Israeli unicorn on the map and its high-profile billboard ad campaign introduced hundreds of its employees to passersby in Tel Aviv.

However, an investigation by "Globes" found that up until 2017, in order to gather data about the popularity of websites and apps, Similarweb engaged in controversial practices that violated the privacy of users. Actions taken by Google and changes in privacy laws in Europe compelled Similarweb to diversify its data sources and purchase statistical information about user figures from partners like cybersecurity companies and telecoms, which enabled it to grow and eventually become a publicly-traded company.

The Tel Aviv-based company's search engine allows measuring the performance of every website and to understand the behavior of its users. Similarweb lets you understand how many users visit, where they are located, and the situation compared with rivals. To a great extent, Similarweb has become the main measurement tool on the Internet.

This has enabled the company to be very successful in business terms. Similarweb raised $232 million as it grew from investors such as Viola, Haim Saban, Moshe Lichtman, Udi Recanati and Yossi Vardi. The company has almost doubled in size over the past two years and currently has 900 employees. Similarweb's Wall Street IPO in May was at a company valuation of $1.6 billion, though since then the share price has fallen 10%.

The company's research reports are quoted throughout the web and its product, a subscription to the databank ranking sites and apps, serves decision makers worldwide in market research, locating potential customers or companies for investment. Despite all this, Similarweb's success in its early years between 2007 and 2017 can be attributed to its information gathering strategy, which included distribution of a range of software programs that violated the terms of Google and Mozilla, which made the Firefox browser, until they removed them from the web.

These practices, which were implemented until 2017, probably have a connection to Similarweb's success in becoming synonymous with Internet research - a brand that in the past belonged to the Alexa ranking engine.

Similarweb began as a supplier of applications for user seeki8ng to create recommendations. Its first application, Similar Sites, provided recommendations of other sites to users and earned major popularity. Only subsequently did the company switch the concept to presenting site rankings and developed the Similarweb application, which in time became the company's name.

Looking over user's shoulders

In 2017, Similarweb acquired a browser extension called Stylish for a bargain price, which allowed users to change the backgrounds of websites. Similarweb had identified an opportunity. In 2018 an American cybersecurity expert Robert Heaton found that Stylish was collecting data on users Internet history on its browser. He claimed that a controversial code had been installed by Similarweb, which allowed it to receive surfing data simultaneously on 1.8 million users.

At the same time, the privacy policy of the extension was changed with a declaration that claimed that the aim of monitoring users was to improve continued use of the extension itself, so that it could learn what type of backgrounds were best suited to which sites and thus make it able to recommend to users to change the background accordingly. Immediately after the report by Heaton, and following criticism from users, Google and Firefox removed the extension from its stores, claiming that it violated their terms.

According to Heaton, the code tracked the full web address, instead of providing just domain names and even collected the Google searchers of the user from their browser. The extension did at least allow users to ask to remove themselves from these collection capabilities and reports by the application. After being removed, Similarweb published the extension anew, without containing the code which contradicted Google and Mozilla's terms.

Even before that in 2016, cybersecurity researchers at Northeastern University found that the Chrome extension linked to Similarweb had collected details of eight million users. The research was published on the site of the US Federal Trade Commission as part of its consumer protection activities and were harshly critical of the behavior, calling it a software spying on users and among other things transferring their web-use history, key search words typed into the search engine and even their history on internal web sites.

The research even located a library of free chrome extensions, which were advertised in the Google store under the name upalytics.com, which tracked users in real time on every site that they looked at. The research also found a connection between Upalytics and Similarweb and a range of related sites such as secureweb24.net, simiolarsites.com, all of them sponsored under the same cloud account and under a service which hid the ownership of who was receiving the data. The research claimed that the aim of the network of sites was to track user behavior on Chrome extensions.

The 42 Chrome extensions featured by the research, including a software for filtering the details of the users' history, were programmed for reading text and to download clips from Facebook, were installed eight million times.

"What is outrageous is that some of these extensions pretend as if they help secure the device with applications such as protection against phishing attacks or filtering content," wrote the researcher Michael Weissbacher.

Among the extensions that the research identified were Do It, a personal motivation and empowerment extension by the actor Shia LaBeouf, which interrupts users and calls out motivational slogans. Another extension blocked video ads. The extension declared that it does not disturb the user experience with ads, something which happens in most other extensions.

A senior source at Similarweb said, "At the same time in the middle of last decade, the rules of what was allowed and prohibited were not clear, and our ability to control our partners on the web was limited. Some of them operated in a way that we would not have expected of them. When Google entered the market, we could control with greater transparency and these phenomena stopped."

Setting out on a new path

Between 2016 and 2019, there were a number of changes in Similarweb's environment, which force it to change the way in which it collects data from users. It began with a change of policy from Google about the distribution of extensions in its Chrome store, which prohibited, for example, collecting data from users in certain ways or restricting their ability to undertake extra actions beyond the declared aim for which the app was opened.

This change harmed not only Similarweb but also a range of Israeli companies who had developed extensions including Coduit, Babylon, Webpick and Superfish. In 2018, the EU's General Data Protection Regulation (GDPR) came into effect, transforming the industry with binding service rules from news sites to Google and Facebook about declaring user privacy and details collected about users.

Similarweb, which had already reached a critical mass of users and proven to Google that its products brought added value to users, designed its products according to the new internal regulatory demands of Google as well as Apple and Mozilla. Today, Similarweb still offers popular applications like Stylus, SimilarWeb and Similar Sites but these comply with the EU regulations and Google's policies and require a specific approval from users regarding data collection from the browser.

During that same period of a change in direction, and at a time when a solution was required for monitoring traffic on mobile phones, market sources claim that there was a temporary fall in the credibility of data. Even today, the information presented many times is approximate data, computing data from dozens of sources, so that it represents an estimation and is a relative rather than absolute number.

Data exchange with Check Point

Similarweb also began partnering with information providers about user habits in various areas including telecom providers and cybersecurity companies like Check Point Software Technologies Ltd. (Nasdaq: CHKP). Unlike with the distribution of applications, these were more expensive deals, for which Similarweb had to pay.

Similarweb's information sources are currently dispersed over four fields: users who agree to share their browsing data on various browsers including Similarweb extensions; extracting data directly from web 'crawlers,' sensors that receive information automatically during Google searches, using Wikipedia, search stores and apps and more; data partnerships with credit card companies, telecom providers, cybersecurity companies and content delivery networks (CDNs); and software allowing websites to share data with Similarweb for marketing needs.

One of those companies is Check Point, which earlier this year signed an agreement to provide Similarweb with aggregated information about the most popular sites in certain countries, while in exchange Check Point will receive names of new domains and can assess the level of their security. "Globes" has been informed that as part of this contract, Check Point explicitly requested that the agreement would not include the Stylish extension and any information transferred between the two companies would not be connected to it.

The senior source in SimilarWeb said, "Even today Similarweb receives information from browser extensions. However, if the app stores decide to remove them for whatever reason, this would have a minimal impact on the performance of the measuring system."

Similarweb said in response to this report," We are talking about repeating foreign reports from 2016 that back then were groundless and were refuted many years ago. The only place where they still exist are in Google back searches and Globes newspaper this evening. Similarweb has one of the strictest compliance and supervision systems in the world and after being thoroughly checked out the company held its IPO on the NYSE several weeks ago."

Check Point declined to comment on the report.

Similarweb

Area of activity Ranking the performance of websites and apps.

History Founded by Or Offer in 2007 as SimilarGroup. IPO in May 2021 at a company valuation of $1.6 billion.

Facts and figures The company has 900 employees, raised $176 million in its IPO and $232 million in private financing rounds.

Something more Similarweb's first application was called Similar Sites and recommended to users similar sites to the one they were currently looking at.

What will the Bank of Israel do if the worst happens?

What will the Bank of Israel do if the worst happens? - Globes

The central bank has published scenarios for the economic consequences of the judicial overhaul, but has not said how it will deal with them.

The forecast of the Bank of Israel Research Department is unusual in its severity in comparison with what we have become accustomed to seeing in previous interest rate announcements. This time, the tone is completely different, and much more pessimistic, with the focus on the far-reaching changes that the government is introducing in Israel’s legal system.

In the best scenario, which the Research Department describes as one in which "the dispute regarding the legislative changes concerning the judicial system is resolved in a way that does not have any effect on economic activity going forward," the central bank’s interest rate is seen at 4.75% in a year’s time, while GDP is expected to grow by 2.5% in 2023 and 3.5% in 2024, with unemployment rising slightly. An interest rate that high has not been seen in Israel for 20 years, and furthermore around the world the talk is of halting and even reversing interest rate hikes.

What will happen, however, if the worst prognostications of the economic consequences of the judicial overhaul are realized? The Bank of Israel warns that GDP could be cut by 2.8% in each of the next three years, but does not set out what it will do if that happens.

The Research Department writes: "In the second scenario, the Research Department presents an analysis of the potential economic implications if the legal and institutional changes are accompanied by an increase in the country’s risk premium, a negative impact to exports, and declines in domestic investments and in demand for private consumption. This scenario is accompanied by a higher level of uncertainty than the standard forecast, regarding the intensity and persistence of the shocks. Therefore, the analysis is presented over a single three-year bloc. The forecast presents an indication of the impact on economic developments and its scale in the coming three years. In a case where the effect of the changes subsides relatively quickly, the impact is estimated at an average of about 0.8 percent of GDP per year over the three-year period being examined. In a case where the perception of the public (the financial markets, the real sector, and consumers) is that the impact of the legislative changes will persist, the impact is estimated at an average of about 2.8 percent of GDP per year over the coming three years."

The big question is, what will the Bank of Israel do if this scenario materializes? How high will interest rates go to douse inflation, and will the Bank of Israel sell dollars to stop the shekel from depreciating? There are no clear answers.

What the Bank of Israel does say is that, in the pessimistic scenario, its interest rate will rise more sharply, depending on the extent of the damage. The effect is estimated at an extra 0.5-1.9% each year, a fairly wide range. The Bank of Israel might have been expected to provide a full picture of the horror forecast, and to say how it is preparing to meet it.

Published by Globes, Israel business news - en.globes.co.il - on April 4, 2023.

Similarweb

About Us | Our Mission, Company, and History | Similarweb

Similarweb - Funding, Financials, Valuation & Investors

https://www.crunchbase.com/

Similarweb Vision

We are committed to powering businesses around the globe with the best digital data.

Similarweb Mission

To create the most accurate, comprehensive, and actionable Digital Data, so every business can win their market

Our company is comprised of over 1,000 employees with locations on six different continents and is publicly traded on the New York Stock Exchange (Ticker: SMWB).

Similarweb analyzes:

1B+ Websites

![]() 8M+ Apps

8M+ Apps

![]()

5B+ Keywords

210+ Industries

![]() 3M Brands

3M Brands

550M Keywords monthly

550M Keywords monthly

1B Events daily

1B Events daily

Similarweb Digital Data and insights power thousands of customers, from small businesses to large international enterprises.

Funding

Funding Rounds

IPO & Stock Price

- Stock Symbol NYSE:SMWB

- Valuation at IPO $1.6B

- Money Raised at IPO $176M

- IPO Share Price $22.00

- IPO Date May 12, 2021

Investors

Acquisitions

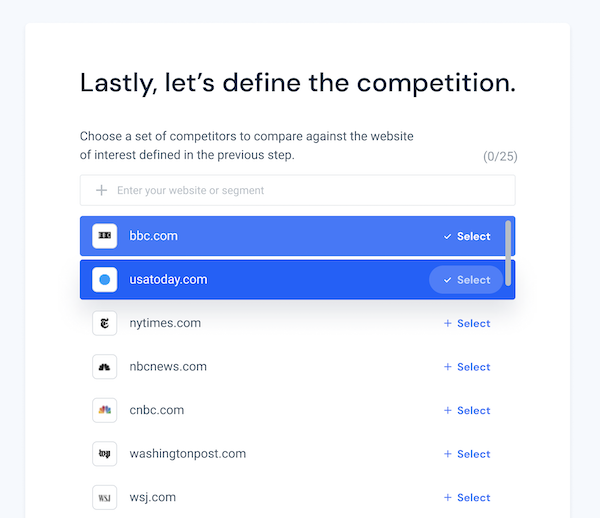

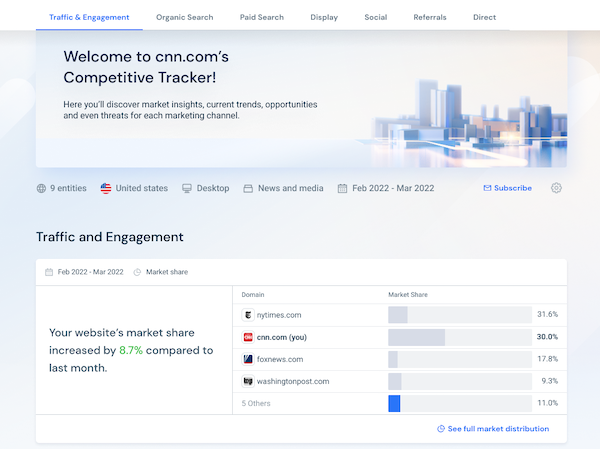

Competitive trackers

Competitive Trackers – Similarweb Knowledge Center

Spend less time digging through data and more time focusing on actionable insights with Competitive Trackers.

Focus on what matters

Use the Competitive Tracker to monitor the digital performance of up to 25 competitor websites and discover shifts in critical performance metrics for the competitive set. With ready-to-use insights and automated alerts, you can stay informed and make data-driven decisions for your business.

Competitive trackers help you:

-

Monitor the digital traffic across your competitive landscape.

-

Get insights into your rivals’ performance across various acquisition channels and uncover opportunities.

-

Quickly surface emerging trends in your competitive set so that you can react fast.

-

Get regular updates and insight highlights delivered directly to your email

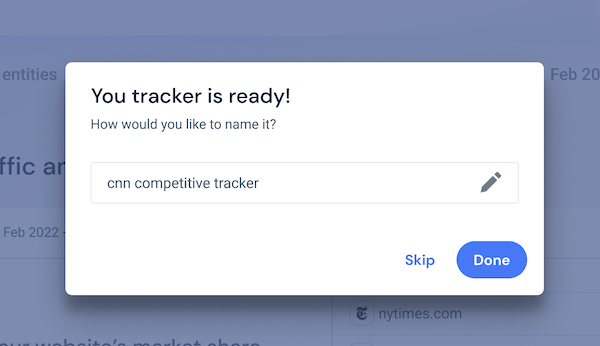

How to set up and use Competitive Trackers:

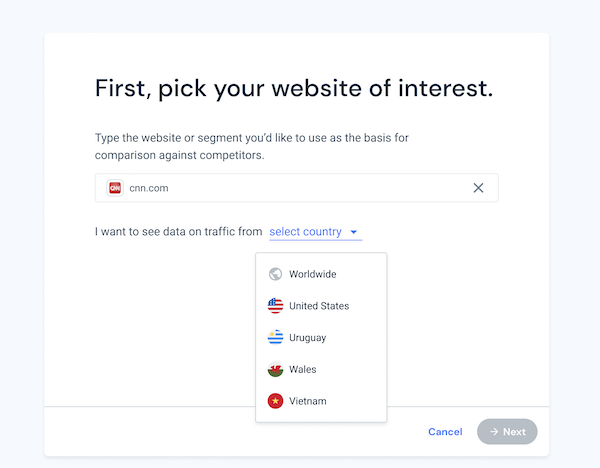

To set up your first tracker:

-

From the sidebar, select Competitive Trackers > + Create a tracker.

-

Enter your website or choose a segment to set as the basis for comparison.

-

Choose which country you'd like to see traffic for, or set the filter to Worldwide to see global traffic data.

Next, choose the industry most relevant for your analysis. Click Next.

-

Choose a set of competitors to track. You can add up to 25 websites to each tracker. Click Finish.

-

Lastly, give your new tracker a name and click Done.

Your Competitive Tracker is created and provides traffic data and insights for the defined competitive set.

-

Hit subscribe to stay alerted to any updates.

The tracker will send monthly insights highlighting key data trends and actionable insights.