Credit Suisse leak unmasks criminals, fraudsters and corrupt politicians

- Massive leak reveals secret owners of £80bn held in Swiss bank

- Whistleblower leaked bank’s data to expose ‘immoral’ secrecy laws

- Clients included human trafficker and billionaire who ordered girlfriend’s murder

- Vatican-owned account used to spend €350m in allegedly fraudulent investment

- Scandal-hit Credit Suisse rejects allegations it may be ‘rogue bank’

-

NuganHandBank CIADrugsDo you remember the Nugan Hand Bank?https://www.inltv.co.uk/index.

php/nuganhandbank-ciadrugs BCCI Tangled Web Banksters - The Untouchable BCCI-Bank Global Finance Scandal P1 of 6BCCI Tangled Web Banksters - The Untouchable BCCI-Bank Global Finance Scandal P2 of 6BCCI Tangled Web Banksters - The Untouchable BCCI-Bank Global Finance Scandal P3 of 6BCCI Tangled Web Banksters - The Untouchable BCCI-Bank Global Finance Scandal P5 of 6BCCI Tangled Web Banksters - The Untouchable BCCI-Bank Global Finance Scandal P6 of 6Mike Ruppert - The CIA Drug Running 911 Bill Gates A CIA Asset

Mike Ruppert Exposes Fascist US-CIA PSYCHOP'H Ad#gendsa21stCENT'Y=GOLD+OIL+

DRUGS =WW-3=IRAN+CHNA+RUSSIA!

CIA Nugan Hand Partying Falcon's Trip The Rio Grande And The Meditteranean Connection Part 1

CIA Nugan Hand Partying Falcon's Trip - The Rio Grande And The Meditteranean Connection Part 2

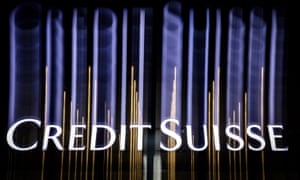

Secret Team Update The Australian Drug Money Connection

by Henry E. Hardyhttps://aadl.org/node/245461

On January 27, 1980, Australian bank co-owner, Frank Nugan, was found dead in his Mercedes-Benz, a single bullet wound through his head. The death was ruled a suicide. In Nugan's briefcase was a long list of prominent personalities in Australian politics, sports, and business. Next to the names were a series of numbers, mostly five and six figure sums. In his wallet was the calling card of the former Director of US Central Intelligence, William Colby. Written on the back of the card was what may have been Colby's projected itinerary in the in the Far East.

The collapse of the Nugan Hand Bank which Frank Nugan co-owned with former CIA operative Michael Hand, came rapidly in the months after his mysterious death. Investigations by the Australian government had already revealed some of the extent of the drug dealing and covert money-laundering practiced by the Nugan Hand Bank. A November 1977 report by the Australian Narcotics Bureau linked the Dugan Hand operation to a drug smuggling network that "exported" some three billion Australian dollars worth of heroin from Bangkok prior to June, 1976.

The activities to the Nugan Hand Bank throw some light on the activities of a mysterious group of current and former high US officials associated with the operation referred to by Maj. General Richard Second in his Iran-Contra testimony as "The Enterprise." (see May, 1987, "Secret Team" edition of AGENDA).

The roots of both the Nugan Hand scandal and the current Iran-Contra "Secret Team" affair lies with the CIA's secret war in IndoChina during the 1950's and 1960's. The CIA allegedly maintained a huge fleet of aircraft under the corporate rubric of "Air America" which facilitated the activities of warlord Vang Pao by bringing in weapons and supplies for the drug-lord's forces and in turn airlifting out his heroin and other drugs for world distribution.

This program was managed by the CIA's station chief Theodore Shackley, and his deputy, Thomas Clines in Laos between 1966 and 1969. Then Lt. Col. Richard Secord coordinated the CIA's air activities. Michael Hand served as a Green Beret assigned to Laos until his "retirement" in 1970. He then joined with Australian financier Frank Nugan in founding the Nugan Hand Bank. The bank was chartered in 1973. By 1979, the bank had twenty-two branches in thirteen nations and over $1 billion in annual business.

In 1975, Nugan Hand client, Edwin Wilson, reportedly cooperated with Shackley and Clines to use the bank as a conduit for funds used to destabilize the Labor Government of Australian Prime Minister E. Gough Whitlam.

In 1976, the bank opened a branch in Chiang Mai, Thailand, in the notorious "Golden Triangle" between Thailand, Burma, and Laos. The office occupied the same office suite and shared the same receptionist as the US Drug Enforcement Agency. The manager of the Nugan Hand Office in Thailand later testified that, "I was never under any illusion at any time that I was to go over there for any other purpose but to seek drug money."

A federal court affidavit filed in December, 1986 by Christic Institute Chief Counsel Daniel Sheehan suggests that the Nugan Hand Bank acted as the middleman in a massive money-laundering operation which made the profits of the China White Heroin trade available for secret wars all over the world, such as the contra activities in Central America. According to the affidavit, a central figure in the "Australian Connection" was Richard Armitage. Armitage was allegedly the "bursar," or bag man for the operation. He is currently Assistant Secretary of Defense for International Security Affairs in the Reagan Administration.

At the time of its collapse, the President of the Nugan Hand Bank was Rear Adm. Earl F. Yates, former commander of the aircraft carrier John F. Kennedy. Other ranking US officials associated with the Australian connection include: the former chief of staff for the US Pacific command, three-star Gen. LeRoy Manor, who headed the Nugan-Hand Bank's Philippine operations; former Assistant Army Chief of Staff for the Pacific, Gen. Edwin Black, who served as head of the bank's Hawaiian office; the former national commander of the American Legion, Gen. Earl Cocke, Jr, whose Washington office served as the Nugan-Hand Bank's Washington headquarters; Walter McDonald, former Deputy Director of CIA, and former CIA Director William Colby were retained by the bank for advice on various matters.

Australia's Joint Task Force on Drug Trafficking issued a four volume report to the parliament on the Nugan Hand Bank in 1983. The commission concluded that the Nugan Hand had participated in two US cover operations. These were the sale of an electronic spy ship to Iran and the shipments to Southern Africa of weapons probably intended for pro-US contra forces in Angola.

Both of these operations involved former CIA agent Edwin Wilson, who was then working for a super-secret Navy Intelligence cell called Task Force 157. Wilson was a business partner of Iran-contra figures Shackley, Clines, contra supply chief Raphael "Chi Chi" Quintero dropped by Wilson's Geneva, Switzerland office. There they found a travel bag of documents left by the head of the bank's Saudi Arabian branch, Bernie Houghton. According to the task force report, Maj. Gen. Secord's name was mentioned as they searched the bag and removed one document. "We've got to keep Dick's name out of this," said Clines.

Maj. Gen. Secord was quoted in The New York Times on May 17, 1987 in regard to the Iran-contra investigations, "This is pipsqueak stuff. When I was in Southeast Asia, we used to pay out people in cash and gold bullion. I've been involved in some of the biggest black bag operations of all time. If I wanted to steal money, I could have been a real winner in those days."

The Australian charges against Shackley, Clines and Secord are supported by another former Wilson associate, Frank Terpil. In a 1983 interview with journalist Jim Hougan, Terpil discussed the significance of "the Enterprise," which has operated out of Miami since 1960. "The significance of Miami is the drug syndicate. That's the base...all the people that I hired to terminate.

The Australian charges against Shackley, Clines and Secord are supported by another former Wilson associate, Frank Terpil. In a 1983 interview with journalist Jam Hougan, Terpil discussed the significance of "the Enterprise," which has operated out of Miami since 1960. "The significance of Miami is the drug syndicate. That's the base...all the people that I hired to terminate other people, from the Agency, are there. They get involved in this biggest drug scandal going, which is whitewashed. Who is the guy behind the scandal? Clines. Who's the boss of Clines? Shackley. Where of they come from? Laos. Where did the money come from? Nugan Hand. The whole goddamned thing has been moved down there...Before that, in Asia, the pilot on the plane was Dick Secord, a Captain in the Air Force. What was on the plane? Gold! Ten million bucks at a time, in gold. H was going to the Golden Triangle to pay off the warlords, the drug lords. Now what do you do with all of the opium? You reinvest it in your own operations. Where? Thailand. You pay it to Alice Springs (top secret US Intelligence facility in Australia.) Billions of dollars - not millions - billions of dollars."

No one has ever been convicted of a crime for the various illegal activities of the Nugan Hand bank. Frank Nugan's Green Beret partner, Michael Hand, disappeared in June of 1980. Bernie Houghton dropped from sight at about the same time. Edwin Wilson is serving a 54 year prison term in the United States for illegal weapons smuggling. Frank Terpil is a fugitive from a 53 year sentence in the Wilson case. His whereabouts remain unknown. Shackley and Clines, although forced to resign from the CIA in 1979, have never faced criminal charges. General Secord remains at liberty to brag about his war exploits, and Richard Armitage remains U.S. Assistant Secretary of Defense.

Banksters- The Untouchable HSBC Bank Global Finance Scandal P1 of 6

Banksters- The Untouchable HSBC Bank Global Finance Scandal P2 of 6

Banksters- The Untouchable HSBC Bank Global Finance Scandal P3of 6

Banksters- The Untouchable HSBC Bank Global Finance Scandal P4 of 6

-

Banksters- The Untouchable HSBC Bank Global Finance Scandal P5 of 6

Banksters- The Untouchable HSBC Bank Global Finance Scandal P6 of 6

Agenda, October 1987

Digitized Articles:- Inside

- Lack Of Proper Testing Keeps Gelman Disaster A Secret For 17 Months

- Why Ann Arbor Needs Rent Control

- News Briefs

- Borders Book Shop

- JUST SAY NO!

- Baker Calls For Campaign Groundrules

- International Volunteers Attacked By Israeli Border Guards

- Table of Contents

- Table of Contents

- Secret Team Update The Australian Drug Money Connection

- Friday Music Nights At Canterbury

- Precision Photographies

- People's Food Co-op

- Paquetta Palmer: Working Toward Social Justice

- National Hero Reduced To Figurehead

- Activism Or Apathy? Student Life In The 80s

- University Goes For Pushbutton Solution

- Academic Word Processing

- Cycle Cellar

- Al's Landscape Maintenance Service

- The Charles Reinhart Co. Realtors

- Partners Press Inc.

- As of September 24, AGENDA has received ...

- Evening Star Futons

- Ann Arbor Toyota Mazda Volvo Yugo

- Rent Stabilization In A Nutshell

- Say What You Will... Good And Evil Won't Be Defined Here

- An Evening with Aleister Crowley

- "Say Goodnight Gracie"

- Are You Going To Tegoose?

- Calendar

- Join Us For The March & Rally

- Mercedes Sosa

- Dayringer Bakery

- Del Rio Bar

- Say Cheese

- Vicki Honeyman

- Community Resource Directory

- Sottini's

- Ivoryphoto

- Gerry Reith's Neutron Gun

- Great Lakes Futon

- Classified_ad

- Art Deco Design Studio

- Classified_ad

- Classified_ad

- Footprints

- Ann Arbor Elmo's

- Declassifieds

- Think Globally--act Globally!!!

- New Pages

- Dawn Treader Book Shops

Michael Craig RuppertBorn February 3, 1951 Washington, D.C.

Died April 13, 2014 (aged 63) Calistoga, California

From 1999 until 2006, Ruppert edited and published From The Wilderness, a newsletter and website covering a range of topics including international politics, the CIA, peak oil, civil liberties, drugs, economics, c

orruption and the nature of the 9/11 conspiracy. It attracted 22,000 subscribers.[1]Michael Craig Ruppert (February 3, 1951 – April 13, 2014) was an American writer and musician, Los Angeles Police Department officer, investigative journalist, political activist, and peak oil awareness advocate known for his 2004 book Crossing The Rubicon: The Decline of the American Empire at the End of the Age of Oil. Ruppert was the subject of the 2009 documentary film Collapse,[3] which is based on his book A Presidential Energy Policy[4] and received The New York Times' "critics pick". He served as president of Collapse Network, Inc. from early 2010 until he resigned in May 2012. He also hosted The Lifeboat Hour on Progressive Radio Network until his death in 2014.

In 2014, Vice featured Ruppert in a 6-part series titled Apocalypse, Man, and a tribute album, Beyond the Rubicon was released by the band New White Trash, of which he had been a member.

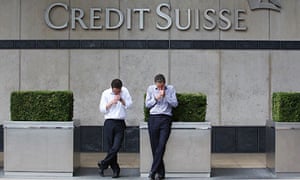

A massive leak from one of the world’s biggest private banks, Credit Suisse, has exposed the hidden wealth of clients involved in torture, drug trafficking, money laundering, corruption and other serious crimes. However, many of its 3,500 relationship managers, who are paid to find and service wealthy clients, are spread across the world. The leaked bank accounts are linked to Credit Suisse clients living in more than 120 different jurisdictions, with a concentration of banking clients in the developing world.

Countries with some of the largest amount of clients in the data, such as Venezuela, Egypt (2,000 plus clients), Ukraine (1,000 plus clients) and Thailand (1,000 plus clients), have long suffered with political and financial elites hiding their fortunes offshore

Details of accounts linked to 30,000 Credit Suisse clients all over the world are contained in the leak, which unmasks the beneficiaries of more than 100bn Swiss francs (£80bn)* held in one of Switzerland’s best-known financial institutions.

The leak points to widespread failures of due diligence by Credit Suisse, despite repeated pledges over decades to weed out dubious clients and illicit funds. The Guardian is part of a consortium of media outlets given exclusive access to the data.

We can reveal how Credit Suisse repeatedly either opened or maintained bank accounts for a panoramic array of high-risk clients across the world.

They include a human trafficker in the Philippines, a Hong Kong stock exchange boss jailed for bribery, a billionaire who ordered the murder of his Lebanese pop star girlfriend and executives who looted Venezuela’s state oil company, as well as corrupt politicians from Egypt to Ukraine.

One Vatican-owned account in the data was used to spend €350m (£290m) in an allegedly fraudulent investment in London property that is at the centre of an ongoing criminal trial of several defendants, including a cardinal.

The huge trove of banking data was leaked by an anonymous whistleblower to the German newspaper Süddeutsche Zeitung. “I believe that Swiss banking secrecy laws are immoral,” the whistleblower source said in a statement. “The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders.”

Credit Suisse said that Switzerland’s strict banking secrecy laws prevented it from commenting on claims relating to individual clients.

“Credit Suisse strongly rejects the allegations and inferences about the bank’s purported business practices,” the bank said in a statement, arguing that the matters uncovered by reporters are based on “selective information taken out of context, resulting in tendentious interpretations of the bank’s business conduct.”

The bank also said the allegations were largely historical, in some instances dating back to a time when “laws, practices and expectations of financial institutions were very different from where they are now”.

While some accounts in the data were open as far back as the 1940s, more than two-thirds were opened since 2000. Many of those were still open well into the last decade, and a portion remain open today.

The timing of the leak could hardly be worse for Credit Suisse, which has recently been beset by major scandals. Last month, it lost its chairman, António Horta-Osório, after he twice broke Covid-19 regulations.

That capped an unprecedented year of controversies in which the bank became embroiled in the collapse of the supply chain finance firm Greensill Capital and the US hedge fund Archegos Capital, and was fined £350m over its role in a loan scandal in Mozambique.

This month, Credit Suisse became the first major Swiss bank in the country’s history to face criminal charges – which it denies – relating to allegation it helped launder money from the cocaine trade on behalf of the Bulgarian mafia.

However, the repercussions of the leak could be much broader than one bank, threatening a crisis for Switzerland, which retains one of the world’s most secretive banking laws. Swiss financial institutions manage about 7.9tn CHF (£6.3tn) in assets, nearly half of which belongs to foreign clients.

The Suisse secrets project sheds a rare light on one of the world’s largest financial centres, which has grown used to operating in the shadows. It identifies the convicts and money launderers who were able to open bank accounts, or keep them open for years after their crimes emerged. And it reveals how Switzerland’s famed banking secrecy laws helped facilitate the looting of countries in the developing world

Banksters - The Untouchable HSBC Bank Global Finance Scandal Full Documentary

Disgraced executives, fraudsters, traffickers – clients

When Ronald Li Fook-shiu approached a banker to open an account in 2000, he is unlikely to have been viewed as a run-of-the-mill client. A former chairman of the Hong Kong stock exchange, he was one of the wealthiest people in the city, where he was known as the “godfather of the stock market”. But he was perhaps better known for the time he spent in a maximum security prison.

FBI knew BCCI financed Iran-Contra deal, bank official says

BCCI Tangled Web Banksters - The Untouchable BCCI - Bank Global Finance Scandal P2

WASHINGTON -- The scandal-ridden Bank of Credit and Commerce International financed the Reagan administration's secret sale of arms to Iran for a profit, but government investigators later covered up the bank's role, a former bank official testified Tuesday.

Abdur Sakhia told a Senate subcommittee that when he was in charge of U.S. operations for BCCI in 1987, FBI investigators asked him for bank records about the arms deal. Upon their delivery, he said, the investigators promised that they would keep the Pakistani-run bank's role 'out of the press.'

Sakhia said he was shown documents indicating that Reagan administration operatives paid the manager of BCCI's Monte Carlo office a $100,000 bribe to arrange a $10 million loan for the weapon purchases, executed by arms dealer Adnian Khashoggi. Sakhia said BCCI apparently approved the deal because it would not fire or suspend the Monte Carlo manager.

The Reagan administration used profits from the arms sales to secretly aid the Nicaraguan Contra rebels after Congress refused to authorize assistance.

Testimony from the government's subsequent Iran-Contra investigation also alluded to the $10 million loan. That testimony revealed Iran was to pay $11 million for the arms, and an undisclosed portion of the $1 million in profit was to go to BCCI.

An FBI spokesman said the agency would have no comment.

BCCI was seized last July by regulators in seven countries after the Bank of England uncovered evidence of fraud, drug trafficking and money laundering. The victims potentially include as many as 1.2 million depositors in the 73 countries where BCCI operated. The accounts of depositors were frozen when the bank was seized.

Sakhia is cooperating with U.S. prosecutors investigating BCCI's secret ownership of the National Bank of Georgia and First American Bankshares in Washington, D.C., which until recently was chaired by longtime Democratic presidential adviser Clark Clifford.

Testifying before the Senate Subcommittee on Terrorism, Narcotics and International Operations, Sakhia:

--Submitted records indicating that BCCI lent Price Waterhouse's Barbados branch $200,000 even though the office audited some of the bank's books for the firm's United Kingdom branch. Those audits have been severely criticized for not revealing the rogue bank's weak financial conditions and its secret and illegal ownership of U.S. banks.

A Price Waterhouse spokeswoman said there was nothing improper about the loan because it was made a couple of years before the audit and was paid back on normal terms.

--Said BCCI officers were jailed for foreign exchange violations in India, Kenya and Sudan but were then released and never prosecuted. He said the bank had paid off the Indira Gandhi family of India, as well as leaders in Pakistan, Bangladesh and a number of African countries, including Kenya, Zimbabwe and Nigeria.

'In some cases cash was given. In some cases their relatives were hired. ... It (the payoff) took many forms,' he said, declining to name the recipients.

--Denied assertions by Clifford and First American's former president, Robert Altman, that they were not informed about BCCI's illegal ownership of their bank holding company. He said Altman even advised BCCI on how it could also secretly acquire a Florida bank. To illustrate the banks' close relationship, Sakhia noted that BCCI founder Agha Hassan Abedi decided which office space should be rented for First American's New York office, and personally hired its top executive.

--Said former Sen. Paula Hawkins, R-Fla., informed him in 1984 of reports that his bank was laundering money, but Justice Department officials told him the bank was not the subject of an investigation.

Sen. John Kerry, D-Mass., who chaired Tuesday's hearing, noted that by that time, the CIA had written a summary of BCCI's illegal operations.

'So the only ones who didn't know were the United States Congress and the United States people,' Kerry said.

A lawyer for Lloyd's of London told the Senate panel last week that the Justice Department since late 1989 ignored the insurer's documented evidence that BCCI was involved in a criminal conspiracy in Florida to launder money and evade taxes and arms-trading regulations.

rchives/1991/10/22/FBI-knew-BCCI-financed-Iran-Contra-deal-bank-official-says/3522688104000/

Bank of Credit and Commerce International - Wikipedia

The Five Biggest Money Laundering Scandals - Sanction Scanner

What were some of the illegal activities that took place at BCCI London bank?

In addition to violations of lending laws, BCCI was also accused of opening accounts or laundering money for figures such as Saddam Hussein, Manuel Noriega, Hussain Muhammad Ershad, and Samuel Doe, and for criminal organizations such as the Medellin Cartel and Abu Nidal

What led to the downfall of the Bank of Credit and Commerce International in 1991?

Following regulatory concerns and investigations BCCI was found to be established fraudulently, trading illegally on a vast scale, including money-laundering and in 1991 regulators raided and shut its operations in seven countries.

Case study: BCCI collapse - Corporate Governance

Tangled Web - BCCI Bank Scandal (1991)

https://www.youtube.com/watch?v=JBBxy9tZOTI

What is the BCCI scandal in the UK?

BCCI SCANDAL: BEHIND THE 'BANK OF CROOKS AND ...

How did HSBC launder money?The HSBC Money Laundering Scandal: A Comprehensive Overview

Which Islamic bank was fined in the UK for anti money laundering violations?

Islamic Bank Fined in U.K. for Anti-Money-Laundering Violations

- Sani Abacha. Sani Abacha was a military dictator who ruled Nigeria from 1993 to 1998. ...

- The Bank of Credit and Commerce International (BCCI) ...

- Benex. ...

- Franklin Jurado. ...

- Nauru. ...

- Al Capone. ...

- Meyer Lansky. ...

- Ferdinand Marcos.

The aim of anti-money laundering is to prevent the most wicked money laundering schemes.

Despite the best efforts of organizations such as FATF, or the Financial Action Task Force, this type of financial crime still runs rampant around the world.

Even though anti-money laundering efforts have been put in place to keep people safe from these types of crimes, history has still seen its fair share of money laundering schemes. Let’s take a look at some of the biggest of all time.

Sani Abacha

Sani Abacha was a military dictator who ruled Nigeria from 1993 to 1998. He and his family managed to transfer roughly $8 billion into foreign bank accounts.

What makes this case so incredible, however, is that he wasn’t just transferring his own money. He was stealing as much as 10% of all of the national income of Nigeria!

Thankfully, after his death, the government of Nigeria was able to get roughly $2 billion back.

Sani Abacha was a military dictator who ruled Nigeria from 1993 to 1998. He and his family managed to transfer roughly $8 billion into foreign bank accounts.

What makes this case so incredible, however, is that he wasn’t just transferring his own money. He was stealing as much as 10% of all of the national income of Nigeria!

Thankfully, after his death, the government of Nigeria was able to get roughly $2 billion back.

The Bank of Credit and Commerce International (BCCI)

Another major money laundering scandal involves BBCI, which was formerly one of the largest private banks in the world. This bank was involved in huge amounts of money laundering during the 1980s.

Drug money and other criminal profits went through the bank, cleaning the money and putting it out into the economy. This was mostly due to the fact that the bank allowed pretty much anyone to open an account. A few notorious clients of the bank include Abu Nidal and Saddam Hussein.

Benex

The Benex Scandal is a scandal where the Russian Mafia was able to use Benex Worldwide accounts from the Bank of New York to launder money. The money was called capital flight money, which means that it was quickly removed from Russia and brought to the United States.

Before the scandal was uncovered, the mafia was able to smuggle roughly $8 billion through the banking system. Luckily, in 2002, a huge police raid took place which shut down the operation.

Franklin Jurado

One man with a Harvard education, Franklin Jurado, received a conviction for laundering $36 million dollars of Colombian drug money. The money was the property of José Santacruz-Londoño, a member of the Cali Cartel.

Jurado was an economics graduate who funnelled the money throughout European businesses and banks. Then, he sent the money back to Colombia and received a fee for his efforts.

In 1996, a bank in Monaco made the connection between his multiple offshore accounts and reported him for money laundering. He spent nearly eight years in jail as penance.

Nauru

A couple of hundred miles off the coast of New Guinea lies a small island named Nauru. Nauru, while a little known place, has played a key role in some major money laundering activities.

During the 1990s, Russian mobsters laundered roughly $70 billion through banks registered in Nauru. They chose Nauru as the location for their money laundering because Nauru doesn’t require banks to record a paper trail of money or to take customer IDs.

Al Capone

One of the most famous mobsters in the United States was Al Capone, who also happened to be a master money launderer. Al Capone earned millions of dollars on his illegal bootlegging business and washed the money through a series of businesses.

His earliest businesses were laundromats. Because they were a cash-based business, they were ideal for laundering and cleaning his money.

In 1931, Capone was indicted. However, he wasn’t indicted for money laundering. He was brought into prison for tax evasion.

Meyer Lansky

After Capone was put in jail, one of his buddies, Meyer Lansky, decided that it was time for him to hide his own money laundering. Lansky was an accountant who had earned plenty of money off the sale of illegal alcohol.

To get rid of the money and avoid incrimination, he laundered nearly $1 billion through a casino empire. He never received a conviction for his crimes and died a very rich man in the early 1980s.

Ferdinand Marcos

The former president of the Phillippines, Ferdinand Marcos, was another prime money launderer. He laundered billions of dollars through Swiss and US banks, all of which had been stolen from public funds.

The Phillippines launched a massive operation to retrieve the money. They were able to recover the majority through an operation which they named “Operation Big Bird”.

President Suharto

One of the most corrupt leaders in the world is President Suharto, a president who ruled Indonesia from 1967 to 1998. Until he was forced to resign, the president had a total of $15 billion.

Out of that money, the president washed more than half in an Austrian bank. He used the offshore banks to wash his illegally earned money and protect him from discovery by the police forces in Indonesia.

Pablo Escobar

One master of financial crime is Pablo Escobar, who was a famous drug lord. Pablo Escobar made so much money on his drug business that he ended up burying hoards of cash because he couldn’t clean it fast enough.

Pablo Escobar was a master money launderer who used big sums of cash to bribe or threaten PEPs, or publicly exposed persons, to help him wash the money. At the height of his career, he was estimated to have roughly $9 billion dollars.

Beat Money Laundering Today

As you can see, there have been some crazy money laundering schemes over the years. Conducting risk analysis and having strong AML practices in place is the key to avoiding getting tangled up in these types of schemes.

Are you ready to take advantage of Fintech and RegTech that protect you and keep your company compliant? Get in touch with DX Compliance Solutions toda

Once one of the largest U.S. banks, Wachovia is unfortunately responsible for the biggest money-laundering event. In 2010, it was found that the bank allowed drug cartels in Mexico between 2004 and 2007 to allow money laundering of close to USD 390 billion through its branches.

During a hearing on General Noriega's drug trafficking and money laundering, BCCI was identified as facilitating Noriega's criminal activity. In March, 1988, ...

https://irp.fas.org/congress/1992_rpt/bcci/02intro.htm

BCCI cannot be taken as an isolated example of a rogue bank, but a case study of the vulnerability of the world to international crime on a global scope that is beyond the current ability of governments to control. Its multi-billion dollar collapse is merely the latest in a series of international financial scandals that have bedeviled international banking this century. Its techniques and its associations with government officials, intelligence agencies, and arms traffickers, were neither new nor unique.

For example, as far back as the 1920's, the International Match Corp bilked shareholders and lenders out of some $500 million through switching company assets and liabilities among a series of shell entities, creating fictional assets when existing ones were adequate, and through transferring funds from the United States offshore. All the while, its chairman, Ivan Kreuger, maintained friendships with numerous world leaders including then U.S. President Herbert Hoover, in a manner reminiscent of BCCI's founder Agha Hasan Abedi's relationships wit President Carter a half a century later.

During the 1960's, the Channel Islands off the coast of England became the host to a series of post-off box banks, including the infamous Bank of Sark, whose facilities including a room over a pub, a desk and a telephone. That headquarters proved adequate to enable the swindlers who established the bank to use it to sell some $100 million in fraudulent checks and letters of credit on the phantom bank before their criminality was discovered.

In the same period, Bernie Cornfeld, chairman of the Investors Overseas Service (IOS), which sold "The Fund of Funds," and fugitive financier Robert Vesco, siphoned off hundreds of millions of dollars from investors in the mutual fund that at its height had $3 billion in assets under its management. In doing so, it moved funds held at Credit Suisse to a small bank which IOS itself owned based in Luxembourg, from which the funds disappeared. Again, this technique anticipated the methods used by BCCI to shift assets from legitimate institutions to its own, and then to engage in wire transfers sufficient to make them impossible to track.

Similar techniques were used by Italian financier Michele Sindona in connection with his management of Banco Ambrosiano in Italy; and by former CIA agent Michael Hand in the drug money laundering Nugan Hand Bank in Australia during the late 1970's and early 1980's. The latter institution had numerous ties to U.S. intelligence and military personnel which have never been explained.

Thus, the rise and fall of BCCI is not an isolated phenomenon, but a recurrent problem that has grown along with the growth in the international financial community itself. Given the extraordinary magnitude of international financial transactions -- which amount to some $4 trillion per day moving through the New York clearance system alone -- the opportunities for fraud are huge, the rewards great, and the systems put in place to protect against them, far from adequate, as this report demonstrates in some detail.

The scope and variety of BCCI's criminality, and the issues raised by that criminality, are immense, and beyond the scope of any single investigation or report. This report, the product of some four years of investigation by the Subcommittee, while extensive, can merely provide a basic guideline to the fundamental facts and issued raised by the BCCI affair.

The Subcommittee investigation of BCCI began in February, 1988, early in the second year of a two-year investigation of the relationship between drug trafficking to U.S. foreign policy and law enforcement that had been authorized by the full Committee. During a hearing on General Noriega's drug trafficking and money laundering, BCCI was identified as facilitating Noriega's criminal activity. In March, 1988, the Foreign Relations Committee authorized the issuance of subpoenas to BCCI and those at the bank involved in handling Noriega's assets, and the accounts of others in Panama and Colombia. Service of those subpoenas was delayed, at the request of the Justice Department and U.S. Customs Service, due to concern that its service could interfere with an ongoing sting operation of BCCI in Tampa, Operation C-Chase. By the time the Subcommittee secured the permission of federal authorities to move forward with service of the subpoena, in late July 1988, the Subcommittee had completed the public hearings in connection with its investigative mandate, and was proceeding to complete its final report, with no further investigative efforts planned.

However, service of the subpoena set into motion a series of contacts during the late summer and early fall involving the Subcommittee, BCCI officials, and BCCI's attorneys, including Clark Clifford and Robert Altman. During those contacts, BCCI officials advised Subcommittee counsel Jack Blum that in their view, BCCI and its attorneys were obstructing the Subcommittee's efforts to investigate the bank. The Subcommittee conducted a deposition of one key BCCI official, Amjad Awan, shortly before his arrest in the Customs' sting, and deposed a second, former BCCI officer following the sting, during the final days of the authorization given the Subcommittee by the Foreign Relations Committee. Thus, as the two-year investigation of the Subcommittee authorized by the Foreign Relations Committee ended, investigating BCCI remained a major piece of unfinished Subcommittee business.

In the spring of 1989, Senator Kerry, chairman of the Subcommittee, authorized Blum as he was leaving the Subcommittee, to provide the information he had developed to the Justice Department. After the Justice Department, in Blum's view, had failed to follow up on the information provided, he took the same information to New York District Attorney Robert Morgenthau, who shortly commenced his investigation of BCCI, based in substantial part on the leads provided him by Blum and the Subcommittee.

In the meantime, Senator Kerry asked two members of his personal staff to continue the investigation from within his personal office until such time as further authorization might be granted from the Foreign Relations Committee, or another Committee of formal jurisdiction for a committee investigation.

During 1989 and 1990, staff in Senator Kerry's office had numerous contacts with BCCI's attorneys, certain BCCI customers, and, in a truncated fashion, with BCCI officials, in an attempt to determine whether allegations concerning BCCI's secret ownership of First American Bankshares were correct, and as part of an effort to identify the extent and nature of BCCI's support of drug money laundering.

In January, 1990, when the Justice Department entered into a plea agreement with BCCI, Senator Kerry criticized the plea agreement for permitting BCCI to avoid trial, and the $14 million fine as insufficient punishment for an institution which had a corporate policy of laundering drug money. At the same time, the Subcommittee published a report on drug money laundering which focused in part on further questions concerning BCCI, including BCCI's alleged secret ownership of First American.

During the spring and summer of 1990, the Senator Kerry's staff conducted further investigative efforts concerning BCCI, met with BCCI's and First American's attorneys on several occasions attempting to obtain BCCI documents. In July, 1990, Senator Kerry, in his capacity as chairman of the Subcommittee, scheduled hearings on BCCI which were postponed after BCCI's attorneys and the Justice Department advised staff that each of the requested witnesses, including BCCI attorney and First American President Robert Altman, would decline the Subcommittee's request to testify.

After efforts to obtain authorization for the investigation within the Banking Committee failed, Senator Kerry decided in early 1991 to formalize the personal staff investigation within the Subcommittee and to seek formal authorization for an investigation from the Foreign Relations Committee, which was granted on May 23, 1991, without dissent. Together with this authorization, the Foreign Relations Committee authorized the issuance of a subpoena to BCCI for records pertaining to its dealings with foreign officials of a number of countries, arms dealers, and focusing on its secret ownership of U.S. financial institutions. At this time, Senator Kerry was joined in further investigative efforts by his ranking member, Senator Brown.

While the Foreign Relations Committee provided consistent support for the Subcommittee's efforts through 1991 and 1992, staffing resources for the investigation remained limited, amounting to two attorneys, with no budget for travel. The lack of resources particularly hampered efforts to investigate matters pertaining to BCCI's activities outside the United States.

Authority for subpoenas and writs were granted by the Committee to the Subcommittee on May 23, 1991, November 27, 1991, February 29, 1992, June 4, 1992. In all, the Subcommittee conducted thirteen days of public hearings, on August 1, 2, 8, October 18, 22, 23, 24, 25, and November 21, 1991; February 19, March 18, May 14, and July 30, 1992; one day of closed hearings, on October 31, 1991 and staffed an additional day of hearings in the Senate Banking Subcommittee on Consumer and Regulatory Affairs on May 23, 1991.

Both by subpoena and by request, documents were received from many institutions, agencies and individuals, including BCCI itself; many of BCCI's attorneys and law firms; many former BCCI officials; representatives of BCCI's creditors and depositors; Price Waterhouse, BCCI's accountants; Clark Clifford and Robert Altman; the First American Bank; the Federal Reserve, Office of Thrift Supervision, Resolution Trust Corporation, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, Majority Shareholders of BCCI (Abu Dhabi), the Central Intelligence Agency, the U.S. Customs Service, the State Department; the Department of Agriculture; former federal prosecutors and investigators; and many others.

In addition, the Subcommittee has been vitally assisted by certain BCCI insiders who, while still working at BCCI during the period of its operation, became sufficiently angered and disgusted by what they had observed that they contacted the Subcommittee and agreed to provide the Subcommittee with information on an ongoing basis. These insiders helped the Subcommittee to document improprieties involving BCCI's attorneys, senior officers, and shareholders, as well as, certain failures to act on information by federal law enforcement.

Many matters remain to be investigated, and these are outlined in the Executive Summary and in the final chapter on conclusions and legislative recommendations.

What is absolutely clear is that the United States needs to exercise far more leadership in helping develop a system for monitoring and regulating the movement of funds across international borders to replace the current, inadequate, patchwork system that BCCI, with all of its faults, so aptly took advantage of to defraud over one million depositors and thousands of creditors from countries all over the world.

Equally important is for the United States to give renewed attention to the difficulty of monitoring the actual circumstances and intentions, of foreign investors seeking to acquire U.S. institutions. As the BCCI case demonstrates, such investments pose special difficulties for both investigation and prosecution should something go wrong.

Finally, influence peddling, the revolving door, and the willingness of well-placed and prominent people in Washington to provide services to whoever wants in the door and is willing to pay ones fees is a phenomenon that poses very substantial dangers for our system of government. As the BCCI case suggests, higher standards of conduct by the private sector in Washington that lives alongside of government is an essential part of making it possible for government to work. The lack of those standards was a significant factor in BCCI's success in committing crimes, and the government's failures in doing anything them.

Disgraced executives, fraudsters, traffickers – clients

Ferdinand and Imelda pillage the Philippines

Swiss banks have cultivated their trusted reputation since as far back as 1713, when the Great Council of Geneva prohibited bankers from revealing details about the fortunes being deposited by European aristocrats. Switzerland soon became a tax haven for many of the world’s elites and its bankers nurtured a “duty of absolute silence” about their clients’ affairs.

The custom was enshrined in statute in 1934 with the introduction of Switzerland’s banking secrecy law, which criminalised the disclosure of client banking information to foreign authorities. Within decades, wealthy clients from all over the world were flocking to Swiss banks. Sometimes, that meant clients with something to hide.

One of the most notorious cases in Credit Suisse’s history involved the corrupt Philippine dictator Ferdinand Marcos and his wife, Imelda. The couple are estimated to have siphoned as much as $10bn from the Philippines during the three terms Ferdinand was president, which ended in 1986.

Credit Suisse helped Ferdinand and Imelda Marcos open Swiss accounts under fake names. Composite: Guardian

When Ronald Li Fook-shiu approached a banker to open an account in 2000, he is unlikely to have been viewed as a run-of-the-mill client. A former chairman of the Hong Kong stock exchange, he was one of the wealthiest people in the city, where he was known as the “godfather of the stock market”. But he was perhaps better known for the time he spent in a maximum security prison.

Li’s career had ended in disgrace in 1990, when he was convicted of taking bribes in exchange for listing companies on the stock exchange. However, a decade later Li was nonetheless able to open an account that later held 59m CHF (£26.3m), according to the leak.

He has since died, but his case is one of dozens discovered by reporters appearing to show Credit Suisse opened or maintained accounts for clients who had serious convictions that might be expected to show up in due diligence checks. There are other instances in which Credit Suisse may have taken quick action after red flags emerged, but the case nonetheless shows that dubious clients have been attracted to the bank.

Like every other bank in the world, Credit Suisse professes to have stringent control mechanisms to carry out extensive due diligence on its customers to “ensure that the highest standards of conduct are upheld”. In banking parlance, such controls are called know-your-client or KYC checks.

A 2017 leaked report commissioned by Switzerland’s financial regulator shed some light on the bank’s internal procedures at that time. Clients would face intensified scrutiny when flagged as a politically exposed person from a high-risk country, or a person involved in a high-risk activity such as gambling, weapons trading, financial services or mining, the report said.

Relationship managers were expected to use external sources to verify customers and their risk levels, according to the leak, including news articles or databases such as the Thomson Reuters World-Check platform, which is used widely in the financial services sector to flag when people are arrested, charged, investigated or convicted of a serious crime.

A massive leak from one of the world’s biggest private banks, Credit Suisse, has exposed the hidden wealth of clients involved in torture, drug trafficking, money laundering, corruption and other serious crimes.

Details of accounts linked to 30,000 Credit Suisse clients all over the world are contained in the leak, which unmasks the beneficiaries of more than 100bn Swiss francs (£80bn)* held in one of Switzerland’s best-known financial institutions.

The leak points to widespread failures of due diligence by Credit Suisse, despite repeated pledges over decades to weed out dubious clients and illicit funds. The Guardian is part of a consortium of media outlets given exclusive access to the data.

We can reveal how Credit Suisse repeatedly either opened or maintained bank accounts for a panoramic array of high-risk clients across the world.

They include a human trafficker in the Philippines, a Hong Kong stock exchange boss jailed for bribery, a billionaire who ordered the murder of his Lebanese pop star girlfriend and executives who looted Venezuela’s state oil company, as well as corrupt politicians from Egypt to Ukraine.

One Vatican-owned account in the data was used to spend €350m (£290m) in an allegedly fraudulent investment in London property that is at the centre of an ongoing criminal trial of several defendants, including a cardinal.

The huge trove of banking data was leaked by an anonymous whistleblower to the German newspaper Süddeutsche Zeitung. “I believe that Swiss banking secrecy laws are immoral,” the whistleblower source said in a statement. “The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders.”

Credit Suisse said that Switzerland’s strict banking secrecy laws prevented it from commenting on claims relating to individual clients.

“Credit Suisse strongly rejects the allegations and inferences about the bank’s purported business practices,” the bank said in a statement, arguing that the matters uncovered by reporters are based on “selective information taken out of context, resulting in tendentious interpretations of the bank’s business conduct.”

The bank also said the allegations were largely historical, in some instances dating back to a time when “laws, practices and expectations of financial institutions were very different from where they are now”.

While some accounts in the data were open as far back as the 1940s, more than two-thirds were opened since 2000. Many of those were still open well into the last decade, and a portion remain open today.

ZurichSwitzerlandUkraineUkraine1,000+ accounts1,000+ accountsThailandThailand1,000+ accounts1,000+ accountsVenezuelaVenezuela2,000+ accounts2,000+ accountsEgyptEgypt2,000+ accounts2,000+ accounts

Credit Suisse has more than 1.6tn CHF (£1.3tn) in assets under management and is one of Switzerland’s largest lenders, second only to UBS. It has almost 50,000 employees, including a significant workforce in Zurich, where the bank is headquartered.

However, many of its 3,500 ‘relationship managers’, who find and serve wealthy clients, are spread across the world. The leaked accounts are linked to Credit Suisse clients living in more than 120 jurisdictions, with a concentration of clients in the developing world.

Countries with some of the largest number of clients in the data, such as Venezuela, Egypt, Ukraine and Thailand, have long struggled with political and financial elites hiding their fortunes offshore.